Having a trading edge is the name of the game in the stock market.

If you have a trading edge, then it's like you're the house at a casino. The casino always has the odds in its favor and over time it generally profits handsomely, even if occasionally a gambler has a lucky day. Similarly, if you have a trading edge, then every time you make a trade the odds are in your favor.

How do you know if you have a trading edge though?

Well you need proof that more often than not, your trading strategy is profitable.

I'm a numbers guy and I take a statistical approach to just about everything I do. I analyzed and dissected historical stock market price data for several years. Through that effort I identified trading strategies that, according to back tests, could have generated profits repeatedly over the last couple decades.

That's what we want in an edge: something where history shows that the odds are in our favor for that trade setup. Where over and over again across 20+ years, the trade setup could have resulted in a profit more often than a loss.

That's the type of edge you can prove: one where there are numbers and data to back it up. A nice, robust, quantifiable edge. These are the types of trades I do through my stock picking service here at Mindful Trader.

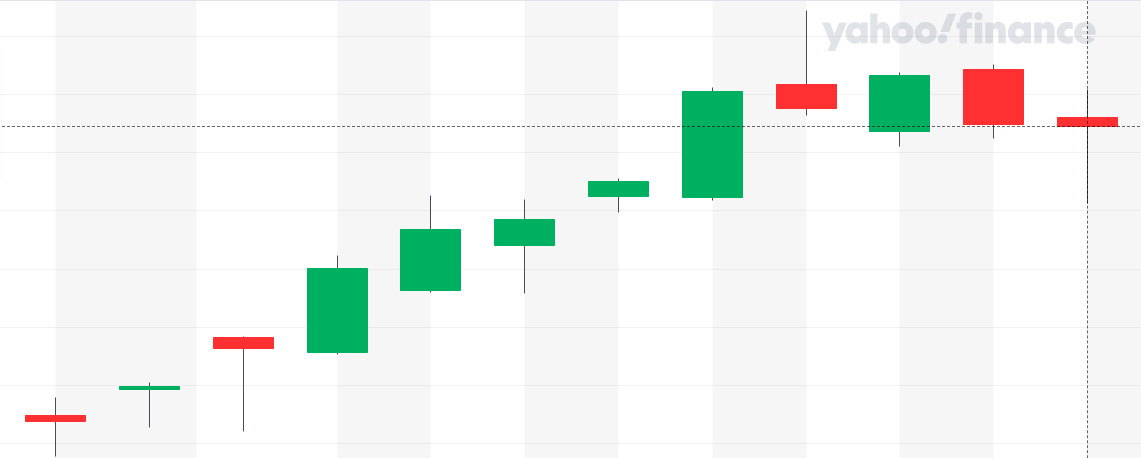

Here's the setup of my favorite trade that has a back-tested edge: If there is a high-visibility stock that has a lot of buying pressure (driving the price up), and then the price kind of tapers off, as if the buying pressure is taking a rest and the price is kind of just drifting, then historically the odds are that the price will go back up relatively soon.

The picture above gives an example of upward driving price movement followed by a period of price "drift". This image was taken from Yahoo Finance.

That's a pretty prime insight that took me a long time to uncover. Knowing that over the course of history, this tendency occurs over and over, it's possible to concoct a trading plan around it that has historically favorable odds.

There are of course a lot of important conditions to consider for the trading plan. What is the market environment? Are there periods where there have been lots of losses in a row even though there is an overall profitable edge historically? What position sizing balances risk with potential profitability?

These are of course exactly the questions I love to research and figure out. I've taken that edge along with a dozen others I found and compiled a portfolio of strategies that perform really well in back tests. I've set up filters for my strategies to ensure they're only activated in the market conditions where they have an edge. I've determined a position sizing approach that balances the risk and reward to my liking and gives a rock-solid back-tested return.

Knowing you have a trading edge in the stock market can be very fun. But it doesn't mean your life will be a cake walk. It's still a challenge to live through the drawdowns and stick to the plan after a string of losses!

Now keep in mind that when I say these trades having a historical edge, it means that when I run my trade strategies through back tests, they are profitable. When I say I did a "back test", it means that I took my trading strategies and applied them against historical stock market activity to see how the trades could have performed. The results of the back tests are not live trading results. These results certainly do not guarantee future results. See my disclaimer here.

If you have questions or feedback, reach out to me any time.