The stock picks and options picks I post are all based on trade strategies I developed through the research of trends and patterns in stock market prices.

These strategies are so carefully manicured that I wrote code to dictate exactly when trade entries and exits are made. In other words, I created algorithms that tell me exactly when a trade strategy is firing and when I need to make a trade. I don't make trades on the fly; I stick to the planned strategies.

When I say I did a "back test", it means that I took my trading strategies and applied them against historical stock market activity to see how the trades could have performed. The results shown on this page are not my live trading results; they are the results of the back tests. These results certainly do not guarantee future results. See my disclaimer here.

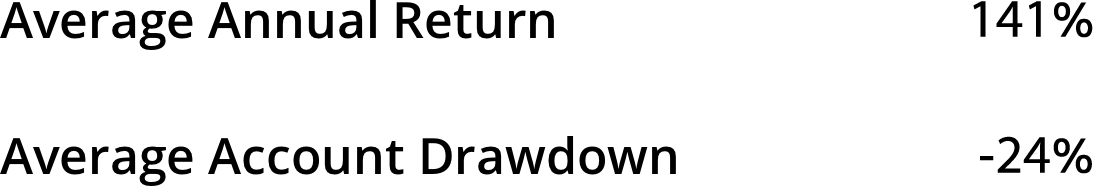

Here is a breakdown of how my trading strategies may have performed over the last 20 years according to back tests (using my preferred position sizing approach):

Those results assume no commissions for stock trades since I don't currently pay any with my TD Ameritrade account. Also they assume that margin buying power is used as needed for stock trades. The results don't include the cost of using margin since I don't have a perfect way to determine historical margin rates. But for reference, in the first three months of live trading with Mindful Trader I incurred a total margin cost of less than 0.5% of my account balance. For more information about assumptions used for back testing, read this page.

I showcase multiple trading accounts with my service. My "Main Account" is the one highlighted above and it features primarily stocks with a sprinkling of options trades mixed in. I also have an account dedicated to options trades that you can learn more about here.

If you want to see a more detailed breakdown of the performance of my portfolio of algorithms in back tests, watch this video:

Considering that many investments out there generate a 5-10% annual return, you can imagine how stratospheric the above returns are in comparison. And these backtests even include tumultuous periods like the 2020 coronavirus and the 2008 financial crash.

To be clear, just because my strategies performed like that in the past does not mean they will perform like that in the future. The future is not guaranteed. But considering that the S&P 500 gives an annual return of 9.72% per year over the last 90 years, you can see the potential.

Here's another way to put this into perspective. If you started with an account balance of $10,000 and were able to earn 141% per year on it and never took any money out of the account, then it would only take about 8 years for your account balance to top the $1 million mark. And that's after taxes (very roughly estimated taxes, and remember I'm not a tax professional). Now this absolutely does not mean I'm telling you to expect 141% returns per year if you sign up for this trade alert service. Remember that the 141% return is based on back tests, which are hypothetical, don't reflect live trades, and have limitations. I'm simply pointing out how big of a deal it would be if that sort of return holds up in live trading. (By the way, it's probably not realistic to say you wouldn't remove money from the account over 8 years. I know I sure would be taking some profits out of the account along the way! Removing profits would dampen the growth potential.)

Although the backtests of my trading strategies have great returns, they also have noteworthy drawdowns. In other words, this isn't a free ride to extreme wealth. The potential for a higher return comes with plenty of risk.

A drawdown measures how far your account balance goes down from its peak. So for example, if you start with a $5,000 trading account, and you get profits that get the account balance up to $10,000, but then you take some losses and the account size is down to $9,000, that's a 10% drawdown. $9,000 is 10% less than $10,000, which was the peak account balance.

In backtests for the Main Account, a typical year had an account drawdown of 24%. To my taste, this is an acceptable amount of risk for the potential of 100%+ annual returns.

Notice that the Options Account had a higher average annual return in back tests, but also a higher average drawdown. The risk and reward potential could be higher with that account.

Compare those results to the S&P 500. You historically could have gotten an annual return of about 10%, and although the typical annual drawdown was lower than that of my back-tested Main Account over the last 20 years (only 10% for the S&P 500), the maximum annual drawdown was higher (49% for the S&P 500 versus 40% for the Main Account). Notice how the max drawdown for the S&P 500 is almost five times higher than its typical return (-49% max risk, +10% typical return), whereas with the back-tested Mindful Trader Main Account the max drawdown is more than three times lower (-40% max risk, +141% typical return). Way more potential reward for the risk being taken, although again keep in mind that the back tested results are hypothetical since they weren't live trades that I made.

As good as my back tested returns sound compared to buying and holding the S&P 500, I don't put every penny I've got into these trades. I only use funds dedicated for hypergrowth where I am ok with a higher level of risk. It's possible to blow out an account when you take an approach to trading that carries this level of risk.

It's extremely important to understand that the above results are based on using my preferred position sizing. I have a healthy appetite for risk, but you might be different than me! If you want less risk, you can dial back the position size.

You can bring the risk way down by, for example, doing only half the position size that I do. If you had done half the position size for each of the trades in my 20-year back test, then the hypothetical drawdowns I listed above would have been cut in half. The hypothetical returns also would have gone down by half, but that might be a perfectly worthwhile and intelligent tradeoff for you.

Ultimately, you can do whatever you want with my service. I post my stock trades and options trades (and even offer training on how you can learn my trade strategies yourself), but it's up to you if you make the trade and if so, how big a position you take.

All the information above conveys the hypothetical results of back tests I ran. To see a sample of my live trading results, click here.