I decided to have a page to highlight the people who have had a large impact on me and on this website.

Below are people who have had a major influence on the way I designed these trading strategies. But first, let me highlight the guy who has the biggest impact: my dad! He's insanely generous in so many ways. Everything I learned in the market all started with him. He has a treasure trove of knowledge. He sparked my initial interest and has been there to offer guidance or inspiration every time I've had set backs. He likes to remind me of a Winston Churchill quote: "Never, never, never, NEVER give up!"

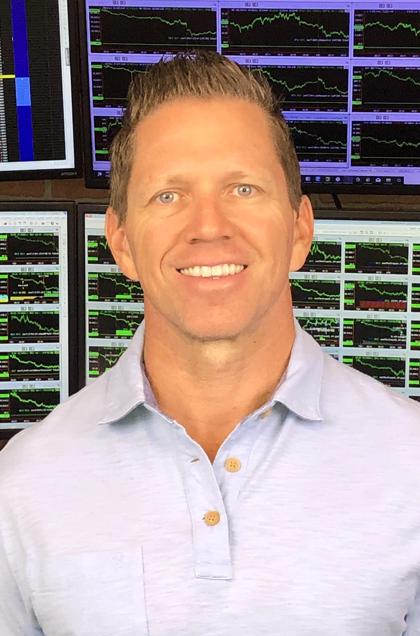

Whenever people ask me the best way to learn how to trade stocks, I tell them about Adam Grimes. Everything about this guy's approach is rock solid. He helped me understand that the majority of what happens in the stock market is random noise, and he gave insights about how to identify those moments in time where there are imbalances and opportunities for profits. Everything he does is based on a statistical backbone, which perfectly matches the approach I like to take. Market Life is one of his websites and has been an awesome resource for me.

He's definitely one of my top inspirations. It might seem funny because the type of trading I do may seem nothing like what he does. He buys massive stakes in companies and he holds it for the very long term (years or decades). Not exactly what we're doing!

But actually some of my core trading principles were inspired by him. The most notable one: patience. When Warren Buffet owns a stock and sees the price go down, he doesn't jump out of his chair and sell. He does absolutely nothing and sticks to the plan. He stays cool! That's a key to the game with trading. He's talked about how he thinks people shouldn't even look at their portfolio performances on a day to day basis, and I feel like I have the exact same mentality. I do have to check each day to make sure the transactions are being executed properly, but if it weren't for that, I would not be checking my account at all on a day-to-day basis. I don't want to be mentally affected by the short term ebb and flow of the account balance.

I enjoyed reading "The Warren Buffet Way" to learn more about him.

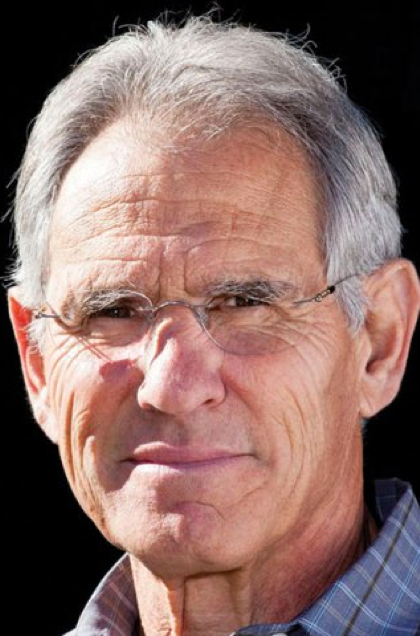

He's a guru of automated trading systems. I learned a ton from his book "Building Winning Algorithmic Trading Systems". He's also actively involved in the industry and offers a lot of webinars and education on websites like futures.io and the TradeStation support forums. He is really down-to-earth and is super easy and fun to work with. A lot of the statistical tests I perform on my automated systems are ones I first learned about from him. He's played a crucial role in my success.

He is another guru of automated trading systems. When I first started trying to build my own algorithms, I bought his book and devoured it ("Algorithmic Trading Systems"). He's got a ton of experience and knows all the potential pitfalls you can encounter when trying to build trading systems. He played a pivotal role in my development.

He wrote a book called "The Definitive Guide to Position Sizing Strategies". He's an expert on the topic of position sizing and compounding, and in his book he explains just about every compounding approach imaginable and their strengths and weaknesses. He came up with a scoring system for how well a given strategy or portfolio will perform with compounding strategies. His scoring system influenced the way I built my portfolio of strategies.

He's a day trader, so his trading is a lot different than what we do since he's in and out of trades very quickly for the most part. But this guy's website, www.investorsunderground.com, taught me a lot about the technical analysis of trading. What's great about him is that he not only taught me a variety of technical indicators (everything from Japanese candle sticks to the ABCD pattern), but he also explained why they might work. He has an excellent understanding of buyers' and sellers' emotions in any given moment, based on the chart setup, and how that can impact the direction of the price.

I learned about him from this website: www.ragingbull.com. I paid for a trading service where he live streamed his screen while he did options trades. What I enjoyed about the time I spent following his service is that he had a largely mechanical approach to his trades. I've never had success with doing trades where my "rules" are changing from day to day; I like to have firm rules that are thoroughly researched so that I can be very consistent with my trading. I also liked the technical chart patterns he looked for. His trading approach gave me inspiration on some of the strategies I use in my automated systems.

I read about her in the book "Momo Traders" and I also learned from her through Nathan Michaud's website. She does swing trading, which is the type of trading we are doing. I learned a lot about technical chart patterns from her as well as trading mentality. She's down to earth, which in my experience is a bit of a rarity in this industry.

He is another automated systems guru. I read his books "Algorithmic Trading" and "Quantitative Trading". He worked at Morgan Stanley and has also run his own hedge fund. He's an expert with the mathematical side of things: he got a PhD in Physics from Cornell and writes largely about the statistical analysis of trading strategies and systems. His books played a role in the way I tested my systems.

He's an options trader who has been around for a long time. The way I was most inspired by him was with the simplicity of his approach. It really resonates with me: keep things simple. If we can come up with a good, simple strategy, then it's easier to be consistent and there's just a lot less work!

Below are people who have had a major impact on my mindfulness journey. But before I get to those guys, I want to point out how much of an impact my mom has on me. She pointed me in the direction of mindfulness several years ago and still talks with me regularly about it, but beyond that she is such a loving person and kind person. So much of what she does is geared toward helping others, and it's deeply inspirational to me. It is my hope that I can reflect that same type of love and kindness toward all of you.

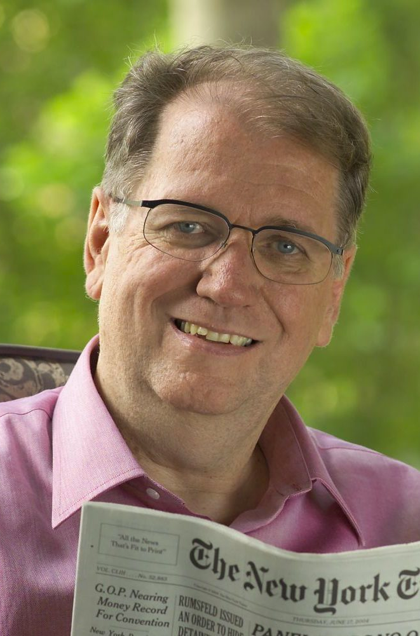

He wrote a couple of books that I love and that I have re-read multiple times. He runs a mindfulness clinic at the University of Massachusetts Medical School and has done a lot of research on the health benefits of mindfulness. My favorite book of his is "Wherever You Go, There You Are". I bought that book for only five bucks at Barnes and Noble, and yet the value it's had for me is off the charts (sometimes you get much more than what you pay for!). That book is for a general audience and talks about how mindfulness can affect your every-day life.

I also have read his book "Full Catastrophe Living" which is geared more toward people struggling with panic, anxiety, depression, or chronic illness/pain. This is the book that gave me clear instructions for how to do meditation.

I still remember when my mom handed his first book to me years ago. It's called "The Power of Now". It's had a tremendous impact on me and I've read it a number of times. It talks about living in the present moment and offers exceptional insights and wisdom and how our minds work. He points out that our minds have a "mind of their own" and how many times our minds are streaming out thoughts that don't correspond with our true intentions. This is relevant to our trading journey because we can kind of separate from our minds, knowing they sometimes run on automatic pilot, and not get all caught up in the mental activity when there are drawdowns or profit surges. In his book, he offers some religious beliefs that I don't necessarily subscribe to, but his depiction of the way to approach life sounds wonderful to me.

He also wrote another book that I love called "A New Earth". In that book he talks about how "thinking happens to us", which is to say that we can't always control what thoughts we have. What we can control, he says, is how we respond to our thoughts. When it comes to trading, it helps a lot to keep that in mind. When there is a drawdown, there will almost assuredly be a thought that goes through your mind that says, "Oh no!" But you get to make a very real decision in that moment: do you keep pulling at that thread and go down rabbit hole to see where that thought leads (typically it leads to getting a whole lot more upset), or do you respond by acknowledging the thought, letting it go, and re-focusing your awareness on what you actually want to be doing in that moment. The choice is yours ultimately, and this book elaborates on these types of concepts.

She's a Buddhist nun and has written a lot of books related to mindfulness. My favorite is "The Places that Scare You". I'm drawn to it in large part because I continue to cope with panic and fear, but it is probably relevant to most people. One thing that she says in there is when you feel an extreme emotion (whether fear or anger, etc), just "cut the storyline" and feel the raw sensations in your body. In other words, don't continue following the train of thought that led you to this emotion. Just let the thought go, which means silencing your mind so to speak, and simply feeling your actual bodily sensations in that moment, whatever they are. I practice this regularly. So much of my suffering is caused by "thinking". Normally the actual sensation caused by the emotion is tolerable; it's just the thinking or visualizing that causes the snowball effect. For example I might get upset about a drawdown, and if I just stopped the mental storyline and sat with the bodily sensation of the anger, that wouldn't be so bad. But when I keep the mental storyline going and I start thinking about all the "potential" implications of having less money, that's when I get more upset. And if I just keeping going and going with the mental storyline, I just dig in further and further to his hole of misery. Instead of giving that mental storyline any energy (especially considering it may not even be true!), we could choose to accept the raw sensation of the emotion itself and drop the thinking. I like re-reading her book occasionally because I find her wisdom to be so insightful.

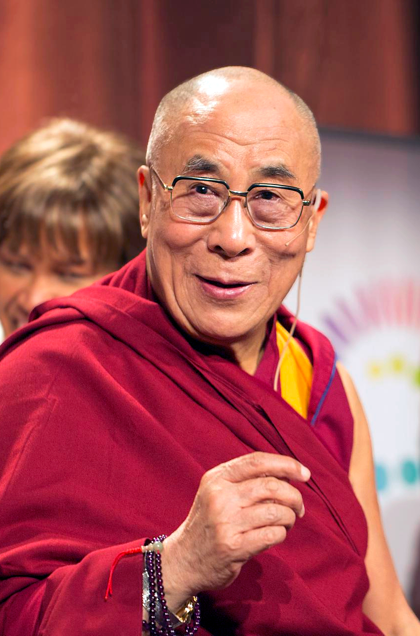

He's a very well-known Tibetan Buddhist monk. This guy is incredible. He is so kind, generous, and loving. He seems to be able to truly feel someone else's suffering, and he focuses almost his entire existence on helping. I read "The Book of Joy", which features an interview with him and Desmond Tutu, and they both discuss what drives lasting joy in life. Both agree: when we aren't so focused on ourselves, and instead are focused on others, that is when the joy starts to really radiate. I found it to be a very inspiring book and I strive to live that way.

That list should give you a flavor of my major influences. Who knows, you might enjoy reading one or more of these. But no worries if you're not interested. They're truly just for your own pleasure or interest. Also, if you have any of your own favorite books that you think I might enjoy, feel free to contact me and share!